☒ | No fee |

☐ | Fee paid previously with preliminary |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and |

300 Crescent Court

April 8, 2022Suite 700

Dallas, Texas 75201

Dear NREF Stockholder:

You are cordially invited to attend the annual meetinga Special Meeting of stockholdersStockholders of NexPoint Real Estate Finance, Inc. The meeting will be held(the “Company”) on Tuesday, May 10, 2022, beginningFriday, January 26, 2024, at 10:309:00 a.m. Central Time. DueTime to consider a proposal (the “Proposal”) to approve the continuing public health impactamendment and restatement of the COVID-19 pandemic, the annual meetingNexPoint Real Estate Finance, Inc. 2020 Long Term Incentive Plan, as described below. The Special Meeting will be held exclusively through a virtual format. You will not be able to attend the annual meeting in person.person. The Board of Directors believes that the Proposal is in the best interest of stockholders because it believes it will ensure we are able to continue to align the interests of management with stockholders. Details regarding the business to be conducted at the Special Meeting are more fully described in the accompanying Notice of Special Meeting of Stockholders and Proxy Statement.

If your shares are held by a financial intermediary (such as a broker-dealer), and you want to participate in, but not vote at the annual meeting, please email AST Fund Solutions, LLC (“AST”) at attendameeting@astfinancial.com, with “NREF Meeting” in the subject line and provide your full name, address and proof of ownership as of April 4, 2022 from your financial intermediary. AST will then email you the annual meeting registration link. Please be aware if your shares are held through a financial intermediary, and you wish to vote at the annual meeting, you must first obtain a legal proxy from your financial intermediary. You may forward an email from your financial intermediary containing the legal proxy or attach an image of the legal proxy via email to AST at attendameeting@astfinancial.com and put “NREF Legal Proxy” in the subject line. AST will then email you the registration link along with a proxy voting control number.

If you are a stockholder of record and wish to attend and vote at the meeting, please send an email to AST at attendameeting@astfinancial.com with “NREF Meeting” in the subject line and provide your name and address in the body of the email. AST will then email you the registration link for the annual meeting. If you would like to vote during the annual meeting, you may do so by entering the control number found on your proxy card.

Requests to attend the annual meeting must be received by AST no later than 2:00 p.m. Central Time on May 9, 2022. On the date of the annual meeting, stockholders are encouraged to log on 15 minutes before the meeting start time. Please contact AST at (877) 283-0325 with any questions regarding accessing the annual meeting.

Information about the meeting, nominees for the election of directors and the other matters to be voted on at the meeting is presented in the following notice of annual meeting and proxy statement. We hope that you will planbe able to virtually attend the annual meeting.

It is important that your shares be represented.Special Meeting. Whether or not you plan to virtually attend, the meeting, please vote using the internet or telephone procedures described on the notice of internet availability of proxy materials or the proxy card or sign, date and promptly mail a proxy card in the provided, pre-addressed postage-paid envelope. Ifpostage paid envelope to assure that your shares are represented at the Special Meeting. Thank you would like to vote duringfor being a stockholder and for your continued investment in the annual meeting, you may do so by entering the control number found on your proxy card.Company.

November 22, 2023  James D. Dondero |

| ||

| |||

NEXPOINT REAL ESTATE FINANCE, INC.

NOTICE OF ANNUALSPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON JANUARY 26, 2024

To be held on May 10, 2022

The 2022 annual meetingA Special Meeting of stockholdersStockholders of NexPoint Real Estate Finance, Inc., a Maryland corporation (the “Company”), will be held virtually, on May 10, 2022, beginningFriday, January 26, 2024, at 10:309:00 a.m. Central Time. Due to the continuing public health impact of the COVID-19 pandemic, the annual meeting will be held exclusively through a virtual format. You will not be able to attend the annual meeting in person. The meeting will be heldTime (the “Special Meeting”), for the following purposes:

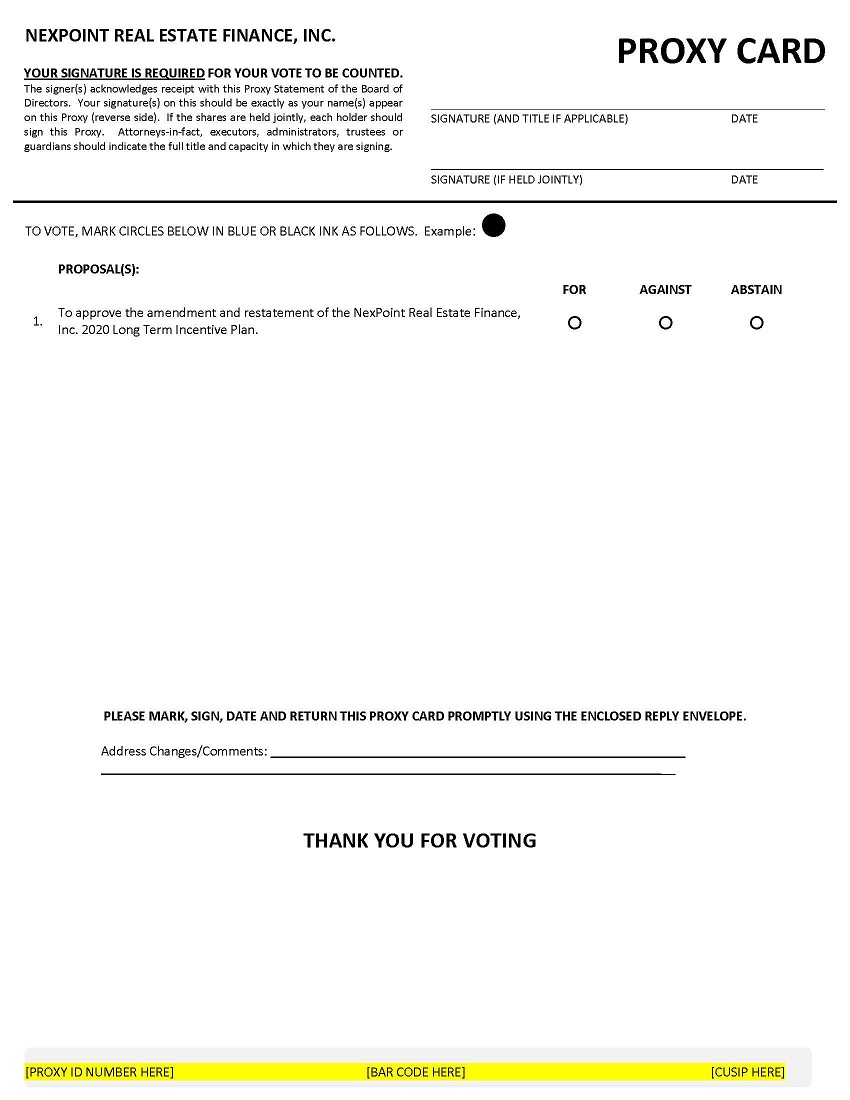

1. To approve the amendment and restatement of the NexPoint Real Estate Finance, Inc. 2020 Long Term Incentive Plan. |

| |

|

| |

|

|

Information concerningThe Board of Directors unanimously recommends that you vote “FOR” the matters toapproval of the proposal.

No other business may be voted uponpresented or transacted at the meeting is set forth in the accompanying proxy statement. We have also provided you or made available to you the Company’s 2021 annual report. Holders of record of the Company’s common stock as of theSpecial Meeting.

The close of business on April 4, 2022 areNovember 20, 2023 has been fixed as the record date for the determination of stockholders entitled to notice of, and to vote at, the meeting.Special Meeting and any adjournment or postponements thereof.

While you will not be able to attend the annual meetingSpecial Meeting in person, we have structured our virtual annual meetingSpecial Meeting to provide stockholders with the same rights as if the meeting were held in person, including the ability to vote shares electronically during the meeting and ask questions in accordance with the rules of conduct for the meeting. To promote fairness and efficient conduct of the meeting, we will respond to no more than two questions from any single stockholder.

If your shares of the Company are held by a financial intermediary (such as a broker-dealer), and you want to participate in, but not vote at the annual meeting,Special Meeting, please email ASTEquiniti Fund Solutions, LLC (“AST”EQ”) at attendameeting@astfinancial.com,attendameeting@equiniti.com with “NREF Meeting” in the subject line and provide your full name, address and proof of ownership as of April 4, 2022November 20, 2023 from your financial intermediary. ASTEQ will then email you the annual meeting registration link. Please be aware if your shares are held through a financial intermediary, and you wish to vote at the annual meeting,Special Meeting, you must first obtain a legal proxy from your financial intermediary. You may forward an email from your financial intermediary containing the legal proxy or attach an image of the legal proxy via email to ASTEQ at attendameeting@astfinancial.comattendameeting@equiniti.com and put “NREF Legal Proxy” in the subject line. ASTEQ will then email you the registration link along with athe proxy voting control number.

If you are a stockholder of record of the Company and wish to attend and vote at the annual meeting, please send an email to ASTEQ at attendameeting@astfinancial.comattendameeting@equiniti.com with “NREF Meeting” in the subject line and provide your name and address in the body of the email. ASTEQ will then email you the registration link for the annual meeting.Special Meeting. If you would like to vote during the annual meeting,Special Meeting, you may do so by entering the control number found on your proxy card.

Requests to attend the annual meetingSpecial Meeting must be received by ASTEQ no later than 2:00 p.m. Central Time on May 9, 2022.Thursday, January 25, 2024. On the date of the annual meeting,Special Meeting, stockholders are encouraged to log on 15 minutes before the meeting start time. Please contact EQ at (877) 283-0325 with any questions regarding accessing the Special Meeting.

Your voteInformation about the meeting and the matter to be voted on at the meeting is very important. Whether or notpresented in the following proxy statement. We hope that you will plan to virtually attend the meeting,Special Meeting.

Please call EQ at (877) 283-0325 for directions on how to attend the Special Meeting.

The Board of Directors is requesting your vote. Your vote is important regardless of the number of shares that you own. Whether or not you expect to be present at the Special Meeting, please vote using the internet or telephone procedures described on the proxy card or sign, date and promptly mail a proxy card in the provided pre-addressed, postage-paidpostage paid envelope. If you would likedesire to vote duringin person at the annual meeting,Special Meeting, you may do so by entering the control number found onrevoke your proxy card.at any time before it is exercised.

Please contact AST at (877) 283-0325 with any questions regarding accessing the annual meeting.

By Order of the Board of Directors, | |||

| |||

| |||

Dallas, Texas

April 8, 2022

Brian Mitts Chief Financial Officer, Executive VP-Finance, Secretary and Treasurer November 22, 2023

|

NexPoint Real Estate Finance, Inc.NEXPOINT REAL ESTATE FINANCE, INC.

300 Crescent Court, Suite 700PROXY STATEMENT

SPECIAL MEETING OF STOCKHOLDERS

JANUARY 26, 2024

Dallas, Texas 75201November 22, 2023

PROXY STATEMENT

This proxy statement provides information in connection with the solicitationThe Board of proxies by the board of directorsDirectors (the “Board”) of NexPoint Real Estate Finance, Inc., a Maryland corporation (the “Company”“Company,” “we,” “us,” or “our”), for use at the Company’s 2022 annual meeting of stockholders or any postponement or adjournment thereof (the “Annual Meeting”). This proxy statement also provides information you will need in order to consider and act upon the matters specified in the accompanying notice of annual meeting. Thisis providing this proxy statement and accompanying proxy card to you in connection with the solicitation of proxies by the Board for a special meeting of our stockholders to be held virtually on Friday, January 26, 2024, at 9:00 a.m., Central time, and any adjournment or postponements thereof (the “Special Meeting”). We are being mailedfirst making these proxy materials available to stockholders on or about April 13, 2022.November 27, 2023.

Record holdersThe Board has fixed November 20, 2023 as the record date (the “Record Date”) for the determination of the Company’s common stock asstockholders entitled to receive notice of, the close of business on April 4, 2022 are entitled toand vote at, the AnnualSpecial Meeting. Each record holderAs of the Record Date, 17,231,913 shares of common stock on that date isof the Company (“Shares”), par value $0.01 per share, were issued and outstanding. Stockholders of the Company are entitled to one vote at the Annual Meeting for each share of common stockShare held. As of April 4, 2022, there were 14,794,255 shares of common stock outstanding.

You cannot vote your shares unless you virtually attend the Annual Meeting or you have previously given your proxy. You can vote by proxy in oneThe mailing address of three convenient ways:our principal executive offices is 300 Crescent Court, Suite 700, Dallas, Texas 75201.

|

| |

THE NOTICE OF SPECIAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT ARE | ||

|

| |

|

|

You may revoke your proxy at any time prior to the vote at the Annual Meeting by:

|

| |

|

| |

|

|

Unless revoked as described above, all properly executed proxies will be voted at the Annual Meeting in accordance with your directions on the proxy. If you hold your shares through a broker, bank, trust or other nominee, please refer to the information forwarded by your broker, bank, trust or other nominee for procedures on revoking your proxy. If a properly executed proxy gives no specific instructions, the shares of common stock represented by your proxy will be voted:

|

| |

|

| |

|

|

If you own shares of common stock held in “street name” and you do not instruct your broker how to vote your shares using the instructions your broker provides you, your shares will be voted in the ratification of the appointment of KPMG as the Company’s independent registered public accounting firm for 2022, but not for any other proposal. To be sure your shares are voted in the manner you desire, you should instruct your broker on how to vote your shares.

Holders of a majority of the outstanding shares of the Company’s common stock must be present, either in person (virtually) or by proxy, to constitute a quorum necessary to conduct the Annual Meeting. Abstentions and broker non-votes are counted for purposes of determining the presence of a quorum.

The following table sets forthNew York Stock Exchange (“NYSE”) rules do not allow a broker, bank or other nominee who holds Shares on your behalf to vote on the voting requirements, whether broker discretionary voting is allowed and the treatmentLong Term Incentive Plan Proposal (described below) without your instructions.

You can vote in advance in one of abstentions and broker non-votes for each of the matters to be voted on at the Annual Meeting.three ways:

by internet  | The web address and instructions for voting BY INTERNET can be found on the enclosed proxy card. You will be required to provide your control number located on the proxy card. |

by phone  | The toll-free number for voting BY TELEPHONE can be found on the enclosed proxy card. You will be required to provide your control number located on the proxy card. |

by mail  | Sign, date and promptly return your proxy card if you are a stockholder of record to authorize a proxy BY MAIL. |

PROPOSAL 1: APPROVAL OF AN AMENDMENT AND RESTATEMENT OF THE NEXPOINT REAL ESTATE FINANCE, INC. 2020 LONG TERM INCENTIVE PLAN

Executive Summary and Selected Plan Information

Introduction | We are asking our stockholders to approve an amendment and restatement of the NexPoint Real Estate Finance, Inc. 2020 Long Term Incentive Plan (the “Existing LTIP”, and as amended and restated, the “Amended LTIP”). On November 6, 2023, the Compensation Committee of the Board (the “Compensation Committee”) recommended that the Board approve the Amended LTIP, and the Board unanimously approved and determined that the Amended LTIP was advisable and in the best interests of the Company and the Company’s stockholders. The Board subsequently directed that a proposal (the “Long Term Incentive Plan Proposal” or the “Proposal”) to approve the amendment and restatement of the Existing LTIP be submitted for consideration by our stockholders at a Special Meeting. The Amended LTIP is based on the Existing LTIP with updates to, among other things, increase the total number of our authorized Shares available for grant, clarify dividends and dividend equivalents payable in connection with the Shares underlying an award under the Amended LTIP are only payable at the time the award vests (or if latter, is settled) and extend the termination date of the Amended LTIP to the tenth anniversary of the effective date of the Amended LTIP, which will be the date the Amended LTIP is approved by our stockholders. Our Board believes that the effective use of equity and equity-linked long-term incentive compensation awards is vital to our ability to attract, retain, reward, and motivate our key employees and directors. Stockholder approval of the Amended LTIP will allow us to continue to provide these incentives. If we do not obtain approval of the Amended LTIP, then once we exhaust the share reserve under the Existing LTIP, we will lose access to an important compensation tool that is key to our ability to attract, motivate, reward, and retain our key management and directors. | |||||||

|

|

|

| |||||

|

|

|

|

| ||||

Expected Duration and Impact on Dilution (as measured through burn rate and overhang) | The Company recognizes the impact of dilution on our stockholders and has evaluated the request for Shares under the Amended LTIP very carefully in the context of the need to motivate, retain and ensure our leadership team is focused on our strategic and long-term growth priorities. Equity is an important component of a compensation program that aligns with our strategy of achieving long-term, sustainable growth. | |||||||

|

|

|

|

|

Attendance at the Annual Meeting will be limited to stockholders of record and beneficial owners who provide proof of beneficial ownership as of the record date in the manner described in the accompanying notice of annual meeting.

While you will not be able to attend the annual meeting in person, we have structured our virtual annual meeting to provide stockholders the same rights as if the meeting were held in person, including the ability to vote shares electronically during the meeting and ask questions in accordance with the rules of conduct for the meeting. To promote fairness and efficient conduct of the meeting, we will respond to no more than two questions from any single stockholder.

The Company pays the costs of soliciting proxies. We have engaged American Stock Transfer & Trust Company, LLC (our “Proxy Solicitor”) to serve as our proxy solicitor for the Annual Meeting at a base fee of $3,500 plus reimbursement of reasonable expenses. Our Proxy Solicitor will provide advice relating to the content of solicitation materials, solicit banks, brokers, institutional investors, and hedge funds to determine voting instructions, monitor voting, and deliver executed proxies to our voting tabulator. The Company may request banks, brokers, and other custodians, nominees, and fiduciaries to forward copies of these proxy materials to the beneficial holders and to request instructions for the execution of proxies. The Company may reimburse these persons for their related expenses. Proxies are solicited to provide all record holders of the Company’s common stock an opportunity to vote on the matters to be presented at the Annual Meeting, even if they cannot attend the meeting in person.

Due to the continuing public health impact of the COVID-19 pandemic, the Annual Meeting will be held exclusively through a virtual format. Please see the other information herein, including the accompanying notice of annual meeting, about how to access the Annual Meeting. As always, we encourage you to vote your shares prior to the Annual Meeting.

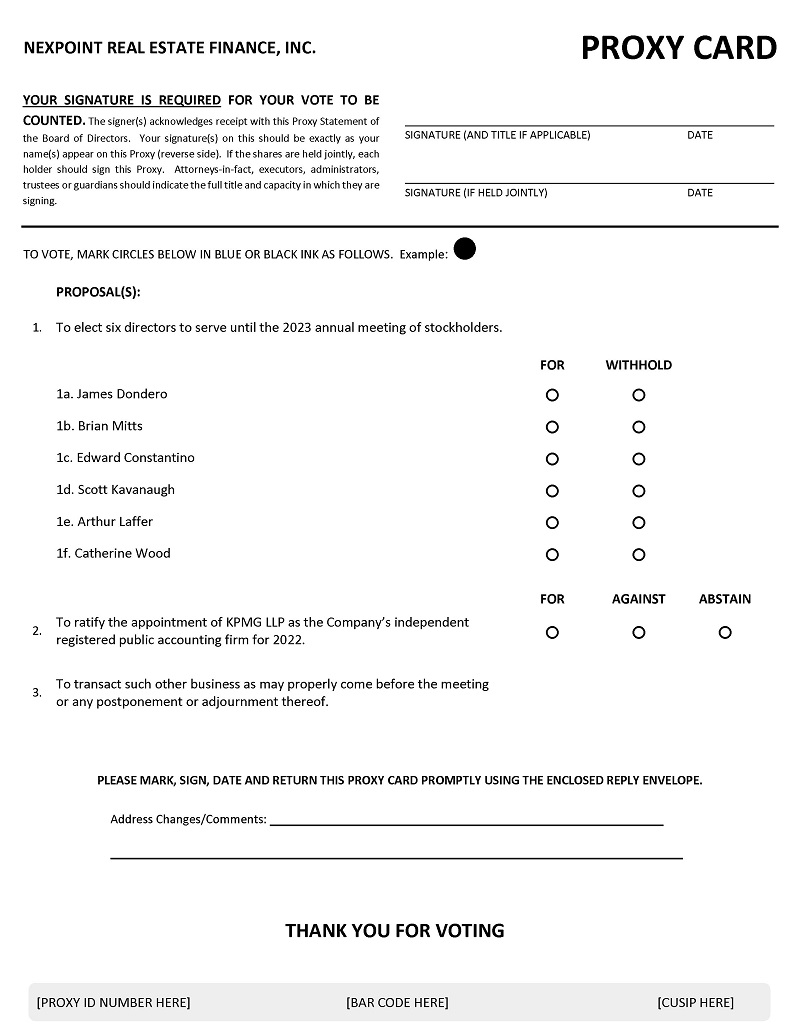

PROPOSAL 1 –ELECTION OF DIRECTORS

| Common measures for the use of stock incentive plans include the burn rate and the overhang rate. The burn rate measures the annual dilution from equity awards granted during a particular year. We have previously issued awards under the Existing LTIP. The three-year average burn rate from fiscal year 2020 to 2022 is 3.7%. The following table provides information regarding our annual burn rate over the past three completed fiscal years. The amounts shown in the table reflect awards granted and Shares outstanding. |

At the Annual Meeting, six directors will be elected to serve one-year terms expiring at our annual stockholders meeting in 2023 and until their respective successors are duly elected and qualified. This section contains information relating to the six director nominees. The director nominees were selected by our nominating and corporate governance committee and approved by the Board for submission to the stockholders. The nominees for election are Messrs. Dondero, Mitts, Constantino, and Kavanaugh, Dr. Laffer and Ms. Wood. All currently serve as directors.

Year | Total Shares Granted (#) | Weighted Avg. Shares Outstanding (#) | Burn Rate (%) | ||||||

2020 | 290,851 | 5,206,101 | 5.6% | ||||||

2021 | 234,586 | 6,601,046 | 3.6% | ||||||

2022 | 276,940 | 14,686,467 | 1.9% |

The Board unanimously recommends a vote FOR the election of each of the nominees.

Nominees to be elected for terms expiring at the Annual Meeting in 2023

James Dondero, age 59, has served as our President and as chairman of our Board since February 2020. Mr. Dondero has also served as President and chairman of the board of directors of NexPoint Residential Trust, Inc. (“NXRT”) since May 2015. Additionally, Mr. Dondero was President and a member of the board of directors of VineBrook Homes Trust, Inc. (“VineBrook”) from February 2019 to August 2021. Mr. Dondero is also: founder and president of NexPoint Advisors, L.P. (our “Sponsor”), an investment advisor registered with the Securities and Exchange Commission (the “SEC”); and chairman of NexBank, SSB (“NexBank”). Mr. Dondero co-founded Highland Capital Management, L.P. (“Highland”) in 1993 with Mark Okada and served as President from 2004 to 2020. Mr. Dondero has over 30 years of experience investing in credit and equity markets and has helped pioneer credit asset classes. Mr. Dondero has also served as the Chief Executive Officer of NexPoint Hospitality Trust, Inc. (“NHT”), a publicly traded hospitality real estate investment trust (a “REIT”) listed on the TSX Venture Exchange, since December 2018. Mr. Dondero also served as a director of Jernigan Capital, Inc. (“JCAP”), a self-storage lending real estate investment trust, from August 2016 to November 2020. Mr. Dondero currently serves on the boards of directors of Metro-Goldwyn-Mayer and SeaOne Holdings, LLC. He also serves as President and Principal Executive Officer of NexPoint Capital, Inc. (“NexPoint Capital”), NexPoint Strategic Opportunities Fund (“NHF”), NexPoint Real Estate Strategies Fund (“NRESF”) and NexPoint Diversified Real Estate Trust (“NXDT”), all of which are affiliates of our Manager. On October 16, 2019, Highland filed for Chapter 11 bankruptcy protection with the United States Bankruptcy Court for the District of Delaware. Mr. Dondero was selected to serve on our Board because of his prior service as a director and his experience as an executive officer.

Brian Mitts, age 51, has served as our Chief Financial Officer, Executive VP-Finance, Secretary and Treasurer since February 2020. Mr. Mitts has served as a member of our Board since June 2019. Mr. Mitts also served as our President and Treasurer from June 2019 until February 2020. Mr. Mitts is also a member of the investment committee of our Manager. Mr. Mitts co-founded NexPoint Real Estate Advisors, L.P. (“NREA”), which is the parent of our Manager, as well as NXRT and other real estate businesses with Mr. McGraner and Mr. Dondero. Currently, Mr. Mitts leads our financial reporting and accounting teams and is integral in financing and capital allocation decisions. Prior to co-founding NREA and NXRT, Mr. Mitts was Chief Operations Officer of Highland Funds Asset Management, L.P., the external advisor of open-end and closed-end funds where he managed the operations of these funds and helped develop new products. Mr. Mitts was also a co-founder of our Sponsor. He has worked for NREA or its affiliates since 2007. Mr. Mitts has also served as a director of NXRT since September 2014 and as the Chief Financial Officer, Executive Vice President-Finance and Treasurer of NXRT since March 2015. In February 2019, Mr. Mitts was also appointed Secretary of NXRT. From September 2014 to March 2015, Mr. Mitts served as President and Treasurer of NXRT. Mr. Mitts has also served as the Chief Financial Officer, Executive VP-Finance, Treasurer and Corporate Secretary of NHT since December 2018. In addition, he has served as a director of VineBrook since July 2018, as Chief Financial Officer, Treasurer and Assistant Secretary of VineBrook since November 2018, and as Interim President since September 2021. From July 2018 to October 2018, Mr. Mitts served as President and Treasurer of VineBrook. Since November 2020, Mr. Mitts has also served as Chief Financial Officer, Secretary and Treasurer of NSP. Mr. Mitts was selected to serve on our Board because of his prior service as a director and his experience as an executive officer.

The overhang rate is a measure of potential dilution to holders of Shares. As of November 20, 2023, there were 17,231,913 of our Shares outstanding, 815,737 Shares subject to outstanding equity awards, 77,302 Shares remaining under the Existing LTIP and 5,038,382 common limited partnership units of the Operating Partnership (defined below) (the “OP Units”) that were redeemable, subject to certain requirements, for cash or, at the election of the Company, Shares on a one-for-one basis. If the Company’s overhang rate is calculated including the potential impact of the redemption of the OP Units, then (a) if we exclude the impact of the new share request, the Company’s overhang rate as of November 20, 2023 is 34.4% on a fully diluted basis, and (b) if the Company includes the new share request of 2,308,000 Shares, the Company’s overhang rate with respect to Shares will be approximately 47.4% on a fully diluted basis. If the Company’s overhang rate is calculated excluding the potential impact of the redemption of the OP Units, then (a) if we exclude the impact of the new share request, the Company’s overhang rate as of November 20, 2023 is 4.73% on a fully diluted basis, and (b) if the Company includes the new share request of 2,308,000 Shares, the Company’s overhang rate with respect to Shares will be approximately 18.13% on a fully diluted basis. The Company believes this is a reasonable level of dilution and provides the Company with the appropriate flexibility to ensure meaningful equity awards in future years to executives and other key employees to better align their interests with the interests of stockholders. | ||

Governance Highlights and Best Practices of the Amended LTIP | The Amended LTIP incorporates certain compensation governance provisions that reflect best and prevalent practices. These include: ● Minimum one-year vesting period, subject to certain exceptions described in the Amended LTIP. ● Annual limit of $350,000 equity compensation that may be paid or awarded to a non-employee director (as such term is used under the Amended LTIP) with respect to his or her service as a director during any fiscal year. ● Prohibition on discounted option rights and stock appreciation rights (“SARs”). ● No repricing of option rights or SARs and no cash buyout of underwater option rights and SARs without stockholder approval. ● No dividends or dividend equivalents paid out currently on unvested awards. ● No dividends or dividend equivalents on option rights or SARs. ● No evergreen features. ● “Double-trigger” vesting for change in control benefits. ● No tax “gross-ups” for excise taxes payable in connection with a change in control. ● Clawback provisions. | |

Plan Term | The Amended LTIP will expire on the tenth anniversary of the date the Amended LTIP was approved by the Company’s stockholders, unless earlier terminated by the Compensation Committee. Awards granted under the Amended LTIP prior to such expiration date shall continue to be controlled by its terms. |

Edward ConstantinoBoard Recommendation

The Board is recommending that the Company’s stockholders vote in favor of the Amended LTIP. The Amended LTIP affords the Compensation Committee the ability to design compensatory awards that are responsive to the Company’s needs and includes authorization for a variety of awards designed to advance the interests and long-term success of the Company by attracting, retaining and motivating (i) officers and certain key employees of the Company and any of its affiliates or subsidiaries, including NexPoint Real Estate Advisors VII, L.P. (our “Manager”) and NexPoint Real Estate Finance Operating Partnership, L.P. (our “Operating Partnership”) (together, the “Company Group”), age 75,(ii) certain persons who provide services to the Company Group, and (iii) the non-employee directors of the Company.

If the Amended LTIP is approved by stockholders, it will be effective as of the day of the Special Meeting. If the Amended LTIP is not approved by our stockholders, no awards will be made under the Amended LTIP and the Existing LTIP will remain in effect in its current form until its expiration date.

In evaluating this Proposal, stockholders should consider all of the information in this Proposal.

The Board has servedunanimously recommended that stockholders vote “FOR” the approval of the amendment and restatement of the NexPoint Real Estate Finance, Inc. 2020 Long Term Incentive Plan.

Summary of Material Terms of the Amended LTIP

The following description of the Amended LTIP and the above executive summary are only a summary of the Amended LTIP’s principal terms and provisions and are qualified in their entirety by reference to the full copy of the Amended LTIP, attached as Appendix A to this proxy statement.

Purpose

The Amended LTIP is designed to provide competitive incentives intended to attract, retain, incentivize and reward eligible participants.

Eligibility for Participation

Certain individuals selected by the Compensation Committee who are an officer or other key employee of the Company Group (or have agreed to serve in such capacity within 90 days of the grant date), a memberperson providing services to the Company Group (provided he or she satisfy the applicable definitions under the general instructions to Form S-8) or a non-employee director of the Company at the time of an award’s grant are eligible to participate in the Amended LTIP. As of November 20, 2023, there were approximately 13 employees of our Board since February 2020. Mr. Constantino has also served as a memberCompany Group and 5 non-employee directors of the boardCompany expected to participate in the Amended LTIP. As of directors of NXRT since March 2015, as a member ofNovember 20, 2023, there were zero consultants expected to participate in the board of directors of VineBrook since February 2019 and as a member ofAmended LTIP.

Plan Administration

The Amended LTIP will generally be administered by the board of trustees of NXDT, a closed-end mutual fund, since March 2020. Mr. Constantino has over 40 years of audit, advisory and tax experience working for two major accounting firms, Arthur Andersen LLP and KPMG. Mr. Constantino retired from KPMG in late 2009, where he was an audit partner in charge of the firm’s real estate and asset management businesses. Mr. Constantino is, and since 2010 has been, a member of the board of directors of Patriot Bank N.A. (“Patriot”). Mr. Constantino has also served as a consultant for the law firm Skadden, Arps, Slate, Meagher & Flom LLP. He is a licensed CPA, a member of the American Institute of Certified Public Accountants and a member of the New York State Society of Public Accountants. He is currently a memberCompensation Committee (or its successor), or any other committee of the Board of Trustees and partdesignated by the Board to administer the Amended LTIP. As plan administrator, the Compensation Committee has broad authority to determine the terms of the Financeawards granted under the Amended LTIP (subject to the terms thereof) and Investmentto make all other determinations it deems necessary or advisable to administer the Amended LTIP properly. The interpretation and construction by the Compensation Committee at St. Francis College in Brooklyn Heights, New York. He is also a Board member and Audit Committee Chair of ARC Trust, Inc. and ARC Trust III, Inc. Mr. Constantino was selected to serve on our Board because of his extensive accounting experience, particularly in the real estate field.

Scott Kavanaugh, age 61, has served as a memberany provision of the Board since February 2020. Mr. Kavanaugh has also served as a memberAmended LTIP or of any award agreement or related document, and any determination by the Compensation Committee pursuant to any provision of the boardAmended LTIP or of directors of NXRT since March 2015any such agreement, notification or document, will be final and as a member of the board of directors of VineBrook since December 2018. Mr. Kavanaugh is, and since December 2009 has been the CEO of First Foundation Inc. (“FFI”), a financial services company. From June 2007 until December 2009, he served as President and Chief Operating Officer of FFI. Mr. Kavanaugh has been the Vice-Chairman of FFI since June 2007. He also is, and since September 2007 has been, the Chairman and CEO of FFI’s wholly owned banking subsidiary, First Foundation Bank. Mr. Kavanaugh was a founding stockholder and served as an Executive Vice President and Chief Administrative Officer and a member of the board of directors of Commercial Capital Bancorp, Inc., the parent holding company of Commercial Capital Bank, from 1999 until 2003. From 1998 until 2003, Mr. Kavanaugh served as the Executive Vice President and Chief Operating Officer and a director of Commercial Capital Mortgage. From 1993 to 1998, Mr. Kavanaugh was a partner and head of trading for fixed income and equity securities at Great Pacific Securities, Inc., a west coast-based regional securities firm. Mr. Kavanaugh is, and since 2009 has been, a member of the board of directors of Colorado Federal Savings Bank and its parent holding company, Silver Queen Financial Services, Inc. Mr. Kavanaugh also served as a member of the boards of directors of NexBank and its parent holding company, NexBank Capital, from 2014 until 2015. Mr. Kavanaugh was selected to serve on the Board because of his expertise in investment management and his experience as both an executive officer and a director of multiple companies.

Dr. Arthur Laffer, age 81, has served as a member of the Board since February 2020. Dr. Laffer has also served as a member of the board of NXRT since May 2015 and as a member of the board of directors of VineBrook since December 2018. Dr. Laffer is the founder and chairman of Laffer Associates, an economic research and consulting firm and served as the chairman and director of Laffer Investments, a registered investment advisor, from 1999 to 2019. Dr. Laffer served as a director of GEE Group, Inc., a provider of specialized staffing solutions, from 2014 to 2020. Dr. Laffer also served as a director of EVO Transportation and Energy Services, Inc. from 2018-2019. A former member of President Reagan’s Economic Policy Advisory Board during the 1980s, Dr. Laffer’s economic acumen and influence have earned him the distinction in many publications as The Father of Supply-Side Economics. He has served on several boards of directors of public and private companies, including staffing company MPS Group, Inc., which was sold to Adecco Group for $1.3 billion in 2009. Dr. Laffer has served as a director of VerifyMe, Inc. since 2019. Dr. Laffer was previously a consultant to Secretary of the Treasury William Simon, Secretary of Defense Donald Rumsfeld, and Secretary of the Treasury George Shultz. In the early 1970s, Dr. Laffer was the first to hold the title of Chief Economist at the Office of Management and Budget under Mr. Shultz. Additionally, Dr. Laffer was formerly the Distinguished University Professor at Pepperdine University and a member of the Pepperdine University board of directors. He also served as Charles B. Thornton Professor of Business Economics at the University of Southern California and as Associate Professor of Business Economics at the University of Chicago. Dr. Laffer was selected to serve on the Board because of his expertise in economics and his experience as a director of multiple companies.

Catherine Wood, age 66, has served as a member of the Board since July 2020. In addition, she has served as a member of the board of directors of NXRT and the board of directors of VineBrook since July 2020. Ms. Wood is currently Chief Executive Officer, Chief Investment Officer, and a board member of ARK Investment Management LLC (“ARK”), an SEC-registered investment advisor, which she founded in January 2014. Ms. Wood is also currently Chief Executive Officer, Chief Investment Officer, and a board member of ARK ETF Trust. Prior to ARK, Ms. Wood spent 12 years at AllianceBernstein as Chief Investment Officer of Global Thematic Strategies. Ms. Wood joined Alliance from Tupelo Capital Management, a hedge fund she co-founded. Prior to her tenure at Tupelo Capital, Ms. Wood worked for 18 years at Jennison Associates LLC as Chief Economic Officer and several other positions. Ms. Wood started her career in Los Angeles at The Capital Group as an Assistant Economist. Ms. Wood received her Bachelor of Science, summa cum laude, in Finance and Economics from the University of Southern California. Ms. Wood was selected to serve on the Board because of her experience as it relates to disruptive technologies, business models and processes, which provides a unique and important perspective to the Board.conclusive.

The Compensation Committee may also delegate all or any part of its authority under the Amended LTIP: (i) to a subcommittee of the Compensation Committee; (ii) if permitted by applicable law and with respect to the committee’s administrative duties and powers, to one or more committee members, officers, agents or advisors of the Company as it deems advisable; and (iii) by resolution to one or more officers of the Company with respect to selecting eligible employee participants (provided they are not subject to Section 16 of the Securities Exchange Act of 1934 (the “Exchange Act”) reporting requirements) and determining award size, subject to certain additional limitations in the Amended LTIP.

PROPOSAL 2 –RATIFICATION OF APPOINTMENT OFKPMG LLP AS THE COMPANY’S INDEPENDENTREGISTERED PUBLIC ACCOUNTING FIRM FOR 2022Shares Available for Awards

The audit committee has appointed KPMGSubject to adjustment as provided in the Company’s independent registered public accounting firmAmended LTIP, the number of Shares available under the Amended LTIP shall not exceed 3,627,734 Shares, which includes the 1,319,734 shares previously approved under the Existing LTIP.

Share Recycling Provisions

If any award granted under the Existing LTIP or the Amended LTIP is cancelled or forfeited, expires or is settled for 2022. The Board is asking stockholderscash (in whole or in part), the Shares subject to ratify this appointment. SEC regulations and New York Stock Exchange (“NYSE”) listing requirements requiresuch award will again be available for issuance under the Company’s independent registered public accounting firmAmended LTIP. However, none of the following Shares will be added back to be engaged, retained and supervisedthe Shares authorized for grant under the Amended LTIP: (a) Shares withheld by the audit committee. However,Company, tendered or otherwise used in payment of the Board considers the selectionexercise price of an independent registered public accounting firmoption right; (b) Shares withheld by the Company or tendered or otherwise used to satisfy tax withholding obligations; (c) Shares subject to a SAR that are not actually issued in connection with its settlement of Shares on exercise thereof; and (d) Shares that are reacquired by the Company on the open market or otherwise using option rights proceeds.

Allowances for Conversion Awards and Assumed Plans

Shares issued or transferred under awards granted under the Amended LTIP in substitution for or conversion of, or in connection with an assumption of, stock or stock-based awards held by awardees of an entity engaging in a corporate acquisition or merger transaction with the Company or any of its subsidiaries will not count against (or be an important matter to stockholders. Accordingly,added back to) the Board considers a proposalaggregate share limit or other Amended LTIP limits described above (“Substitute Awards”). Additionally, shares available under certain plans that we or our subsidiaries may assume in connection with corporate transactions from another entity may be available for stockholders to ratifycertain awards under the Amended LTIP, under the circumstances further described in the Amended LTIP, but will not count against the aggregate share limit or other Amended LTIP limits described above (“Assumed Plan Awards”).

Minimum Vesting Requirement

Notwithstanding anything else contained in this appointment to be an opportunity for stockholders to provide inputProposal to the audit committeecontrary, except in the case of Substitute Awards, Assumed Plan Awards and cash incentive awards, awards that are granted under the Board onAmended LTIP will be subject to a key corporate governance issue.minimum vesting period of one year from the date of grant (“Minimum Vesting Requirement”). Notwithstanding the foregoing, the award may provide for acceleration of vesting in the event of a participant’s retirement, death or disability or in the event of a double-trigger change in control of the Company (as described below). The Compensation Committee may grant awards covering up to 5% of the maximum number of Shares reserved for issuance under the Amended LTIP (subject to adjustment as provided in the Amended LTIP) for issuances under the Amended LTIP, without regard to the Minimum Vesting Requirement.

RepresentativesTypes of KPMG are expected to virtually attendAwards Under the Annual Meeting and will have the opportunity to make a statement. They will also be available to respond to appropriate questions.Amended LTIP

Selection. KPMG served as the Company’s independent registered public accounting firm for 2021 and 2020, and has been selected by the audit committee to serve as the Company’s independent registered public accounting firm for 2022.

Audit and Non-Audit Fees. The following table presents fees for audit services rendered by KPMG for the audit of the Company’s annual financial statements for 2021 and 2020, and fees billed for other services rendered by KPMG.

DECEMBER 31, 2021 | DECEMBER 31, 2020 | |||||||

Audit Fees (1) | $ | 672,000 | $ | 606,000 | ||||

Audit-Related Fees | — | — | ||||||

Tax Fees | 135,575 | — | ||||||

All Other Fees | — | — | ||||||

Total | $ | 807,575 | $ | 606,000 | ||||

|

|

Pursuant to the charterAmended LTIP, the Company may grant option rights (including “incentive stock options” (“ISOs”) as defined in Section 422 of the audit committee,Internal Revenue Code of 1986, as amended (the “Code”)), SARs, restricted stock, restricted stock units (“RSUs”), performance shares, performance units, cash incentive awards, profits interest units and certain other awards based on or related to our Shares.

Each grant of an award under the audit committee is responsible forAmended LTIP will be evidenced by an award agreement or agreements which will contain such terms and provisions as the oversight of our accounting, reporting and financial practices. The audit committee has the responsibility to select, appoint, engage, oversee, retain, evaluate and terminate our external auditors; pre-approve all audit and non-audit services to be provided,Compensation Committee may determine, consistent with all applicable laws,the Amended LTIP. Each award may be subject to us by our external auditors; and establishtime-based, service-based or performance-based vesting. Any award under the fees and other compensation to be paid to our external auditors.

The audit committee has adoptedAmended LTIP may provide for acceleration of vesting in the event of a policy to pre-approve all audit and permitted non-audit services provided by our principal independent accountants. All audit and non-audit services for 2021 were pre-approved byparticipant’s retirement, death or disability or in the audit committee.

The Board unanimously recommendsevent of a vote FOR the ratificationdouble-trigger change in control of the appointmentCompany (as described below). A brief description of KPMG as the Company’s independent registered public accounting firm for 2022.types of awards which may be granted under the Amended LTIP is set forth below.

THE BOARD, ITS COMMITTEES AND ITS COMPENSATION

Board of Directors

The Board presently consists of six members, four of whom are non-management directors. Each director serves a one-year term expiring at each annual meeting of stockholders and lasting until his or her respective successor is duly elected and qualified.

Director Compensation in 2021

Directors who are officers of the Company do not receive compensation for their service as directors.

We provide the following compensation for non-management directors:

Option Rights |

|

| ||

| Each grant of an option right will specify the | |||

| In addition, each grant will specify the | |||

SARs |

| The Amended LTIP provides for the | ||

Each grant of a SAR will be evidenced by an award agreement which specifies the applicable terms and conditions of such award, including any vesting and forfeiture provisions (whether based on service, performance or otherwise), as specified by the Compensation Committee. A SAR may be paid in cash, Shares or any combination thereof. Except with respect to Substitute Awards and Assumed Plan Awards, the base price of a SAR may not be less than the fair market value of a Share on the date of grant. The term of a SAR may not extend more than ten years from the date of grant. SARs granted under the Amended LTIP may not provide for dividends or dividend equivalents. | ||||

|

| |||

We also reimburse directors for all expenses incurred in attending Board and committee meetings.

Director Compensation Table

The following table provides information regarding the compensation of our non-management directors for the year ended December 31, 2021.

NAME | FEES EARNED OR | STOCK | TOTAL | |||||||||

Edward Constantino | $ | 35,000 | $ | 57,355 | $ | 92,355 | ||||||

Scott Kavanaugh | $ | 37,500 | $ | 57,355 | $ | 94,855 | ||||||

Dr. Arthur Laffer | $ | 27,500 | $ | 57,355 | $ | 84,855 | ||||||

Catherine Wood | $ | 20,000 | 57,355 | $ | 77,355 | |||||||

|

| |

Mr. Mitts, who serves as a director and our Chief Financial Officer, Executive VP-Finance, Secretary and Treasurer, is an executive officer who does not receive any additional compensation for services provided as a director. Due to the fact that Mr. Mitts is not a named executive officer, his employee compensation is omitted from the table above and the Summary Compensation Table herein.

Director Independence

The Board will review at least annually the independence of each director. During these reviews, the Board will consider transactions and relationships between each director (and his or her immediate family and affiliates) and the Company and its management to determine whether any such transactions or relationships are inconsistent with a determination that the director is independent. This review will be based primarily on responses of the directors to questions in a directors’ and officers’ questionnaire regarding employment, business, familial, compensation and other relationships with the Company and our management. Our Board has determined that each of Edward Constantino, Scott Kavanaugh, Dr. Arthur Laffer and Catherine Wood is independent in accordance with NYSE listing standards. As required by NYSE, our independent directors will meet in regularly scheduled executive sessions at which only independent directors are present.

Corporate Governance

We believe that good corporate governance is important to ensure that, as a public company, we will be managed for the long-term benefit of our stockholders. We and our Board have reviewed the corporate governance policies and practices of other public companies, as well as those suggested by various authorities in corporate governance. We have also considered the provisions of the Sarbanes-Oxley Act and SEC and NYSE rules.

Based on this review, we have established and adopted charters for the audit committee, compensation committee and nominating and corporate governance committee, as well as corporate governance guidelines and a code of business conduct and ethics applicable to all of our directors, officers and employees.

Our committee charters, code of business conduct and ethics and corporate governance guidelines are available on our website nref.nexpoint.com in the Governance section. Copies of these documents are also available upon written request to our Corporate Secretary at c/o NexPoint Real Estate Finance, Inc., 300 Crescent Court, Suite 700, Dallas, Texas 75201, Attn: Corporate Secretary. We will post information regarding any amendment to, or waiver from, our code of business conduct and ethics on our website in the Governance section.

Furthermore, our insider trading policy prohibits our directors and certain employees, including all of our executive officers, from engaging in hedging transactions with respect to our securities, including entering into options, warrants, puts, calls or similar instruments or selling our securities short.

The Board periodically reviews its corporate governance policies and practices. Based on these reviews, the Board may adopt changes to policies and practices that are in the best interest of our stockholders and as appropriate to comply with any new SEC or NYSE rules.

Board Leadership Structure and Board’s Role in Risk Oversight

James Dondero, our President, serves as Chairman of the Board. The Board believes that combining these positions is the most effective leadership structure for the Company at this time. As President, Mr. Dondero is involved in day-to-day operations and is familiar with the opportunities and challenges that the Company faces at any given time. With this insight, he is able to assist the Board in setting strategic priorities, lead the discussion of business and strategic issues and translate Board recommendations into Company operations and policies.

The Board has appointed Scott Kavanaugh as its lead independent director. His key responsibilities in this role include:

| Any grant of restricted stock shall require that any or all dividends or distributions paid on the restricted stock during the period of such restrictions shall be automatically deferred and paid on a contingent basis based on the participant earning the restricted stock with respect to which such dividends are paid. | |||

|

| ||

Performance Shares, Performance Units and Cash Incentive Awards |

|

| |

|

| ||

Profits Interest Units | A profits interest unit is a unit of the Operating Partnership which is intended to constitute a “profits interest” within the meaning of Internal Revenue Service (“IRS”) Revenue Procedures 93-27 and 2001-43. Profits interest units are a form of appreciation award that is valued by reference to the value of a limited partnership interest in the Operating Partnership. Each grant of profits interest units shall be evidenced by an award agreement setting forth the award’s applicable terms and conditions, including the applicable vesting and forfeiture provisions (whether based on service, performance or otherwise), as determined by the Compensation Committee. | ||

|

| ||

| A profits interest unit may only be issued to a participant for the performance of services to, or for the benefit of, the Operating Partnership in the participant’s capacity as a |

Other Awards |

|

| |

|

| ||

|

| ||

|

| ||

|

| ||

| |||

|

|

RiskAdjustments; Corporate Transactions

If there is inherentany change in the Company’s capitalization (including resulting from a stock split) or a corporate transaction (including a merger, consolidation, spin-off, split-off, spin-out, split-up, reorganization, redomestication, partial or complete liquidation or other distribution of assets, or issuance of rights or warrants to purchase securities), the Compensation Committee will adjust the number and kind of Shares or other securities permitted to be delivered under the Amended LTIP, adjust the terms of outstanding awards, including the number and kind of Shares or other securities subject to outstanding awards, in each case as and to the extent the Compensation Committee determines an adjustment to be appropriate and equitable, to prevent dilution or enlargement of rights.

In the event of any such transaction or event, or in the event of a change in control of the Company, the Compensation Committee may provide in substitution for any or all outstanding awards under the Amended LTIP such alternative consideration (including cash), if any, as it may in good faith determine to be equitable under the circumstances and will require in connection therewith the surrender of all awards so replaced in a manner that complies with every business and we face a numberSection 409A of risks. Management is responsible for the day-to-day management of risks, while the Board, as a whole and through our audit committee, is responsible for overseeing our management and operations, including overseeing its risk assessment and risk management functions. Code.

“Double-Trigger” Accelerated Vesting upon Change in Control

The Board has delegated responsibility for reviewing our policiesAmended LTIP includes “double-trigger” acceleration provisions with respect to risk assessment and risk management to our audit committee through its charter. The Board has determined that this oversight responsibility can be most efficiently performed by our audit committee as partthe vesting of its overall responsibility for providing independent, objective oversightawards in connection with respect to our accounting and financial reporting functions, internal and external audit functions and systems of internal controls over financial reporting and legal, ethical and regulatory compliance. Our audit committee regularly reports to the Board with respect to its oversight of these areas.

Board Meetings

The Board held five meetings during the fiscal year ended December 31, 2021. Each director serving on the Boarda change in 2021 attended at least 75%control of the total numberCompany. Under the Amended LTIP, the vesting of meetings ofawards will accelerate in connection with a change in control only where either (a) within a specified period the Board andparticipant’s service is involuntarily terminated by the total number of meetings ofCompany for reasons other than for cause or the committees on which he or she served during the time they served on the Board. Under our corporate governance guidelines, each director is expected to devote the time necessary to appropriately dischargeparticipant terminates his or her responsibilities and to rigorously prepareemployment or service for attend and participategood reason or (b) the award is not assumed or converted into a replacement award in all Board meetings and meetings of committees on which he or she serves.

Director Attendance at Annual Meetings of Stockholders

The Company’s directors are encouraged to attend our annual meeting of stockholders, but we do not currently have a policy relating to directors’ attendance at these meetings. All ofmanner described in the Company’s directors at the time of the 2021 annual meeting of stockholders attended the 2021 annual meeting.award agreement.

Board Committees

Our Board has an audit committee, a compensation committee and a nominating and corporate governance committee. The composition and responsibilities of each committee are described below. Members will serve on these committees until their resignation or until otherwise determined by the Board.

Audit Committee

Our audit committee consists of Mr. Constantino, Mr. Kavanaugh, Dr. Laffer and Ms. Wood, with Mr. Constantino serving as chair of the committee. The Board has determined that each of Mr. Constantino, Mr. Kavanaugh and Dr. Laffer qualify as an “audit committee financial expert” as that term is defined by the applicable SEC regulations and NYSE corporate governance listing standards. The Board has also determined that each of Mr. Constantino, Mr. Kavanaugh, Dr. Laffer and Ms. Wood is “financially literate” as that term is defined by the NYSE corporate governance listing standards and is independent as defined by NYSE rules and SEC requirements relating to the independence of audit committee members. Our Board has determined that Mr. Constantino’s simultaneous service on the audit committees of more than two other public companies would not impair his ability to effectively serve on our audit committee. Our Board also determined that Mr. Constantino’s service on the other companies’ audit committees did not hinder his ability to serve on our audit committee as he is currently retired and not serving in an executive officer capacity for another company. The audit committee met five times during the fiscal year ended December 31, 2021. Our audit committee charter details the principal functions of the audit committee, including oversight related to:

our accounting and financial reporting processes;

|

| |

|

| |

|

| |

|

| |

|

|

The audit committee is also responsible for engaging an independent registered public accounting firm, reviewing withAmended LTIP includes a definition of “change in control.” In general, except as may be otherwise prescribed by the independent registered public accounting firmCompensation Committee in any award agreement, a change in control will be deemed to have occurred if: (a) individuals who constitute the plans and resultsBoard on the effective date of the audit engagement, approving professional services provided by the independent registered public accounting firm, including all audit and non-audit services, reviewing the independenceAmended LTIP cease for any reason to constitute at least a majority of the independent registered public accounting firm, consideringBoard, unless their replacements are approved as described in the rangeAmended LTIP (subject to certain exceptions described in the Amended LTIP); (b) a person or group becomes the beneficial owner of audit and non-audit fees and reviewing35% or more of the adequacythen-outstanding Shares or the combined voting power of our internal accounting controls. The audit committee also preparesthen-outstanding securities entitled to vote generally in the audit committee report required by SEC regulationselection of directors, subject to certain exceptions; (c) the Company closes a reorganization, merger, consolidation, significant sale or purchase of assets, in each case which causes the persons or groups who are the beneficial owners of 35% or more of the then-outstanding Shares or the combined voting power of our then-outstanding securities entitled to vote generally in the election of directors to cease to be included in our annual proxy statement. A copysuch beneficial owners of the audit committee charter is available underentity resulting from such transaction, in substantially the Governance sectionsame proportions of ownership as immediately prior to such transaction, as further described in the Amended LTIP; (d) the Company’s website at nref.nexpoint.com.stockholders approve its complete liquidation or dissolution; or (e) the Manager is terminated.

Compensation CommitteeManagement Objectives

Our compensation committee consistsThe Amended LTIP permits the Company to grant awards subject to the achievement of Dr. Laffer, Mr. Kavanaugh, Mr. Constantino and Ms. Wood, with Dr. Laffer servingcertain specified management objectives. Management objectives are defined as chairthe measurable performance objective or objectives established pursuant to the Amended LTIP for participants who have received grants of performance shares, performance units or cash incentive awards or, when so determined by the Compensation Committee, option rights, SARs, restricted stock, RSUs, dividend equivalents or other awards. Management objectives may be described in terms of company-wide objectives or objectives that are related to the performance of the committee.individual participant or of one or more of the subsidiaries, divisions, departments, regions, functions or other organizational units within the Company or its subsidiaries. The Board has determined that each of Dr. Laffer, Mr. Kavanaugh, Mr. Constantino and Ms. Wood is independent as defined by NYSE rules and SEC requirements relatingmanagement objectives may be made relative to the independenceperformance of compensation committee members. The compensation committee met five times during the fiscal year ended December 31, 2021. Our compensation committee charter details the principalother companies or subsidiaries, divisions, departments, regions, functions or other organizational units within such other companies, and may be made relative to an index or one or more of the compensation committee, including:performance objectives themselves.

Forfeiture and Recoupment Any award agreement may provide for the cancellation or forfeiture, or the forfeiture and repayment to the Company of any proceeds, gains or other economic benefit that the participant actually or constructively receives related to a Share-based or cash-based award under the Amended LTIP (including any related dividends, dividend equivalents or amounts received on the resale of Shares related to the award), or other provisions intended to have a similar effect, upon such terms and conditions as may be determined by the Compensation Committee from time to time. In addition, notwithstanding anything in the Amended LTIP to the contrary, the Amended LTIP and all awards issued thereunder (including any dividends, dividend equivalents, proceeds, gains or other economic benefit Participant actually or constructively receives related to the award or amounts received on the resale of Shares related to the award) shall be subject to any compensation recovery and/or recoupment policy adopted by the Company to comply with applicable law, including, without limitation, Section 10D of the Exchange Act, any applicable rules or regulations promulgated by the Securities and Exchange Commission or any national securities exchange or national securities association on which our Shares may be traded, or to comport with good corporate governance practices, as such policies may be amended from time to time. Effective Date and Term of the Amended LTIP |

| |

|

| |

|

| |

|

| |

|

| |

|

|

The compensation committee hasAmended LTIP will become effective on the sole authoritydate it is approved by the Company’s stockholders and will terminate as to retainfuture awards on the tenth anniversary thereof, unless earlier terminated by the Compensation Committee.

Amendment and terminate compensation consultantsTermination of the Amended LTIP

The Board may amend the Amended LTIP at any time, but no amendment, alteration or termination of the Amended LTIP may materially and adversely impair the rights of any participant with respect to assistoutstanding awards without the participant’s consent or permit the Board to amend awards in violation of the Amended LTIP’s prohibition on repricing underwater option rights and SARs. In addition, the Board would need stockholder approval of an amendment if it (a) would materially increase the benefits accruing to participants under the Amended LTIP, (b) would materially increase the number of securities which may be issued under the Amended LTIP, (c) would materially modify the requirements for participation in the evaluationAmended LTIP, or (d) must otherwise be approved by the Company’s stockholders in order to comply with applicable law or the rules of our compensationthe stock exchange(s) on which the Shares are traded. Stockholder approval will be obtained to increase the Share Reserve (subject to adjustment as described above), and for any amendment that would require such approval to comply with any rules of the sole authority to approvestock exchange(s) on which the fees andShares are traded or other retention terms of such compensation consultants.applicable law. The committeeBoard may, in its discretion, delegate specific duties and responsibilities to a subcommittee or an individual committee member, toterminate the extent permitted by applicable law. The committee is also able to retain independent counsel and other independent advisors to assist it in carrying out its responsibilities. A copyAmended LTIP at any time. Termination of the compensation committee charter is availableAmended LTIP will not affect the rights of participants or their successors under any awards outstanding and not exercised in full on the Governance sectiondate of the Company’s website at nref.nexpoint.com.termination.

Nominating and Corporate Governance Committee

Our nominating and corporate governance committee consists of Mr. Kavanaugh, Mr. Constantino, Dr. Laffer and Ms. Wood, with Mr. Kavanaugh serving as chair of the committee. The Board has determined that each of Mr. Kavanaugh, Mr. Constantino, Dr. Laffer and Ms. Wood is independent as defined by NYSE rules. The nominating and corporate governance committee met five times during the fiscal year ended December 31, 2021. Our nominating and corporate governance committee charter details the principal functions of the nominating and corporate governance committee, including:

|

|

|

|

Material U.S. Federal Income Tax Consequences

|

|

|

|

|

|

|

|

|

|

|

|

The nominatingfollowing discussion of certain relevant United States federal income tax effects applicable to certain awards granted under the Amended LTIP is only a summary of certain of the United States federal income tax consequences applicable to United States residents under the Amended LTIP, and corporate governance committeereference is made to the Code for a complete statement of all relevant federal tax provisions. No consideration has been given to the sole authorityeffects of foreign, state, local and other laws (tax or other) on the Amended LTIP or on a participant, which laws will vary depending upon the particular jurisdiction or jurisdictions involved. In particular, participants who are stationed outside the United States may be subject to retainforeign taxes as a result of the Amended LTIP.

Tax Consequences to Participants

Nonqualified Option Rights: An optionee subject to United States federal income tax will generally not recognize taxable income for United States federal income tax purposes upon the grant of a nonqualified stock option. Rather, at the time of exercise of the nonqualified stock option, the optionee will recognize ordinary income, and terminate any search firmthe Company will be entitled to assista deduction, in an amount equal to the excess of the fair market value of the Shares on the date of exercise over the exercise price. If the Shares acquired upon the exercise of a nonqualified stock option are later sold or exchanged, then the difference between the amount received upon such sale or exchange and the fair market value of such shares on the date of such exercise will generally be taxable as long-term or short-term capital gain or loss (if the shares are a capital asset of the optionee), depending upon the length of time such shares were held by the optionee.

Incentive Stock Options: An optionee subject to United States federal income tax will generally not recognize taxable income for United States federal income tax purposes upon the grant of an ISO (within the meaning of Section 422 of the Code) and the Company will not be entitled to a deduction at that time. If the ISO is exercised during employment or within 90 days following the termination thereof (or within one year following termination, in the identificationcase of director candidatesa termination of employment due to retirement, death or disability, as such terms are defined in the Amended LTIP), the optionee will not recognize any income and the sole authorityCompany will not be entitled to set the fees and other retention terms of such search firms.a deduction. The committee is also able to retain independent counsel and other independent advisors to assist it in carrying out its responsibilities. A copyexcess of the nominating and corporate governance committee charter is available under the Governance sectionfair market value of the Company’s website at nref.nexpoint.com.Shares on the exercise date over the exercise price, however, is includible in computing the optionee’s alternative minimum taxable income.

CodeGenerally, if an optionee disposes of Business Conductshares acquired by exercising an ISO either within two years after the date of grant or one year after the date of exercise, the optionee will recognize ordinary income, and Ethicsthe Company will be entitled to a deduction, in an amount equal to the excess of the fair market value of the shares on the date of exercise (or the sale price, if lower) over the exercise price. The balance of any gain or loss will generally be treated as a capital gain or loss to the optionee. If the Shares are disposed of after the two-year and one-year periods described above, the Company will not be entitled to any deduction, and the entire gain or loss for the optionee will be treated as a capital gain or loss.

We have adoptedSARs: A participant subject to United States federal income tax who is granted a written code of business conduct and ethics that applies to our directors and executive officers, who are employees of our Manager. Among other matters, our code of business conduct and ethics is designed to deter wrongdoing and to promote:

|

|

|

|

|

|

|

|

|

|

A copy of our code of business conduct and ethics is available under the Governance sectionSAR will not recognize ordinary income for United States federal income tax purposes upon receipt of the Company’s website at nref.nexpoint.com. WeSAR. At the time of exercise, however, the participant will also providerecognize ordinary income equal to the value of any cash received and the fair market value on the date of exercise of any Shares received. The Company will not be entitled to a copydeduction upon the grant of a SAR, but generally will be entitled to a deduction for the amount of income the participant recognizes upon the participant’s exercise of the SAR. The participant’s tax basis in any person, without charge,Shares received will be the fair market value on the date of exercise and, if the shares are later sold or exchanged, then the difference between the amount received upon written request to our Corporate Secretary at c/o NexPoint Real Estate Finance, Inc., 300 Crescent Court, Suite 700, Dallas, Texas 75201, Attn: Corporate Secretary. Wesuch sale or exchange and the fair market value of the shares on the date of exercise will post information regarding any amendment to,generally be taxable as long-term or waiver from, our codeshort-term capital gain or loss (if the shares are a capital asset of business conduct and ethics on our website under the Governance section.participant) depending upon the length of time such shares were held by the participant.

QualificationsRestricted Stock: A participant subject to United States federal income tax generally will not be taxed upon the grant of a restricted stock award, but rather will recognize ordinary income for Director Nominees

The nominating and corporate governance committee is responsible for reviewing withUnited States federal income tax purposes in an amount equal to the Board, at least annually, the appropriate skills and experience required for membersfair market value of the Board. This assessment includes factors such as judgment, skill, diversity, integrity, experience with businesses and other organizationsshares at the time the restricted stock is no longer subject to a substantial risk of comparable size,forfeiture (within the interplaymeaning of the candidate’s experience withCode). The Company generally will be entitled to a deduction at the experiencetime when, and in the amount that, the participant recognizes ordinary income on account of other Board members,the lapse of the restrictions. A participant’s tax basis in the shares will equal the fair market value of those shares at the time the restrictions lapse, and the extent to whichparticipant’s holding period for capital gains purposes will begin at that time. Any cash dividends paid on the candidate wouldshares before the restrictions lapse will be a desirable additiontaxable to the Board and any committeesparticipant as additional compensation (and not as dividend income). Under Section 83(b) of the Board.Code, a participant may elect to recognize ordinary income at the time the restricted stock is awarded in an amount equal to their fair market value at that time, notwithstanding the fact that such shares are subject to restrictions and a substantial risk of forfeiture. If such an election is made, no additional taxable income will be recognized by such participant at the time the restrictions lapse, the participant will have a tax basis in the restricted stock equal to their fair market value on the date of their award, and the participant’s holding period for capital gains purposes will begin at that time. The Company generally will be entitled to a tax deduction at the time when, and to the extent that, ordinary income is recognized by such participant.

Board DiversityRestricted Stock Units: A participant subject to United States federal income tax who is granted an RSU will not recognize ordinary income for United States federal income tax purposes upon the receipt of the RSU, but rather will recognize ordinary income in an amount equal to the fair market value of the Shares at the time of settlement, and the Company will have a corresponding deduction at that time.

The nominatingPerformance Shares, Performance Units, Other Share-Based and corporate governance committeeCash-Based Awards: In the case of other stock-based and other cash-based awards, depending on the form of the award, a participant subject to United States federal income tax will not be taxed upon the grant of such an award, but, rather, will recognize ordinary income for United States federal income tax purposes when such an award vests or otherwise is free of restrictions. In any event, the Company will be entitled to a deduction at the time when, and in the amount that, a participant recognizes ordinary income.

Profits Interest Units: A participant subject to United States federal income tax who is granted a profits interest unit generally is not expected to recognize taxable income at the time of grant or the vesting of those units, provided that (a) the award qualify as “profits interests” within the meaning of IRS Revenue Procedures 93-27 and 2001-43; (b) the participant does not havedispose of the units within two years of issuance; and (c) certain other requirements are met. Participants generally would make the election provided for under Section 83(b) of the Code, recognizing zero income at the time of grant, in which case the profits interest units could be disposed of within two years of issuance. As a formal policy regardingholder of profits interest units, however, a participant will be required to report on his or her income tax return his or her allocable share of the considerationOperating Partnership’s income, gains, losses, deductions and credits in accordance with the Partnership Agreement, regardless of diversity for director candidates. The nominating and corporate governance committee does, however, consider diversitywhether the Operating Partnership actually makes a distribution of cash to the grantee. Distributions of money by the Operating Partnership to the participant, will generally be taxable to the grantee to the extent that such distributions exceed the participant’s tax basis in the Operating Partnership. Any such gain generally will be capital gain, but a portion may be treated as partordinary income, depending on the assets of its overall selection strategy. The nominating and corporate governance committee considers diversity in its broadest sense, including diversity in professional and life experiences, education, skills, perspectives and leadership, as well as other individual qualities and attributesthe Operating Partnership at that contributetime. Generally, no deduction is available to Board heterogeneity, such as race, ethnicity, sexual orientation, gender and national origin. Importantly, the nominating and corporate governance committee focuses on howCompany upon the experiences and skill setsgrant, vesting or disposition of each director nominee complements those of fellow directors and director nominees to create a balanced Board with diverse viewpoints and deep expertise.the units.

Tax Withholding: The Company believes thathas the inclusionright to deduct or withhold, or require a participant to remit to the Company, an amount sufficient to satisfy federal, state, and local taxes (including employment taxes) required by law to be withheld with respect to any exercise, lapse of diversityrestriction or other taxable event arising as onea result of many factors considered in selecting director nominees is consistent withgrants under the Company's goal of creating a board of directors that best serves our needs and those of our stockholders.plans.

Below is a summaryCertain Tax Code Limitations on Deductibility: Section 162(m) of the experience and skills, gender, age and tenureCode generally limits the deductible amount of total annual compensation paid by a public company to each “covered employee” to no more than $1 million. In addition, our directors, and whetherability to obtain a deduction for future payments could be limited by Section 280G of the directorsCode, which provides that certain payments made in connection with a change in control are racially or ethnically diverse.not deductible by the Company (and may be subject to additional taxes for the grantee).

Section 409A: Some awards under the plans may be considered to be deferred compensation subject to Section 409A of the Code. Failure to satisfy the applicable requirements under this provision for awards considered deferred compensation would result in the acceleration of income and additional income tax liability to the recipient, including certain penalties. |

|

|

|

|

| |

|

|

|

|

| ||

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|